Semiconductors

The chip industry in figures

Wich industry is most dependent on microchips and who dominates the market? An overview of the most important facts.

Digitalization

Close to Core Business

Henrik Hahn, Evonik’s Chief Digital Officer, talks about the role played by digitalization in the chemical industry.

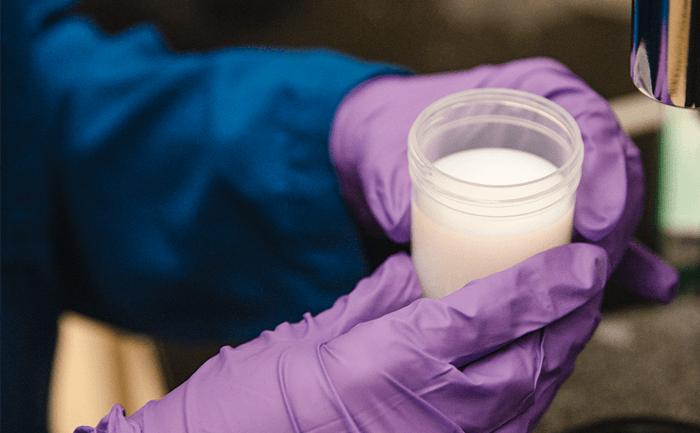

Batteries

Stored Power

Researchers are working on innovative energy storage systems—and discovering new potential in established technologies.

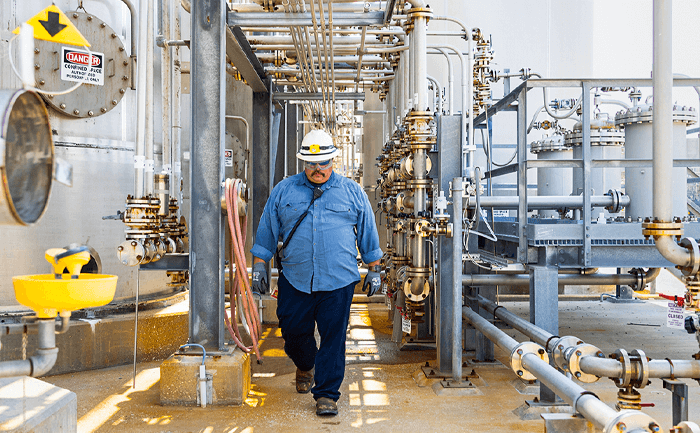

Evonik Country

USA: Endless opportunities

The USA is a pioneer when it comes to important future technologies—and that’s one reason why it’s Evonik’s second home.

ELEMENTS Newsletter

Get fascinating insights into the research Evonik is conducting, and its social relevance, by subscribing to our free newsletter.