Water electrolysis

The membrane is the key

AEM electrolysis is expected to produce large amounts of green hydrogen. A new membrane will make it possible.

The energy transition

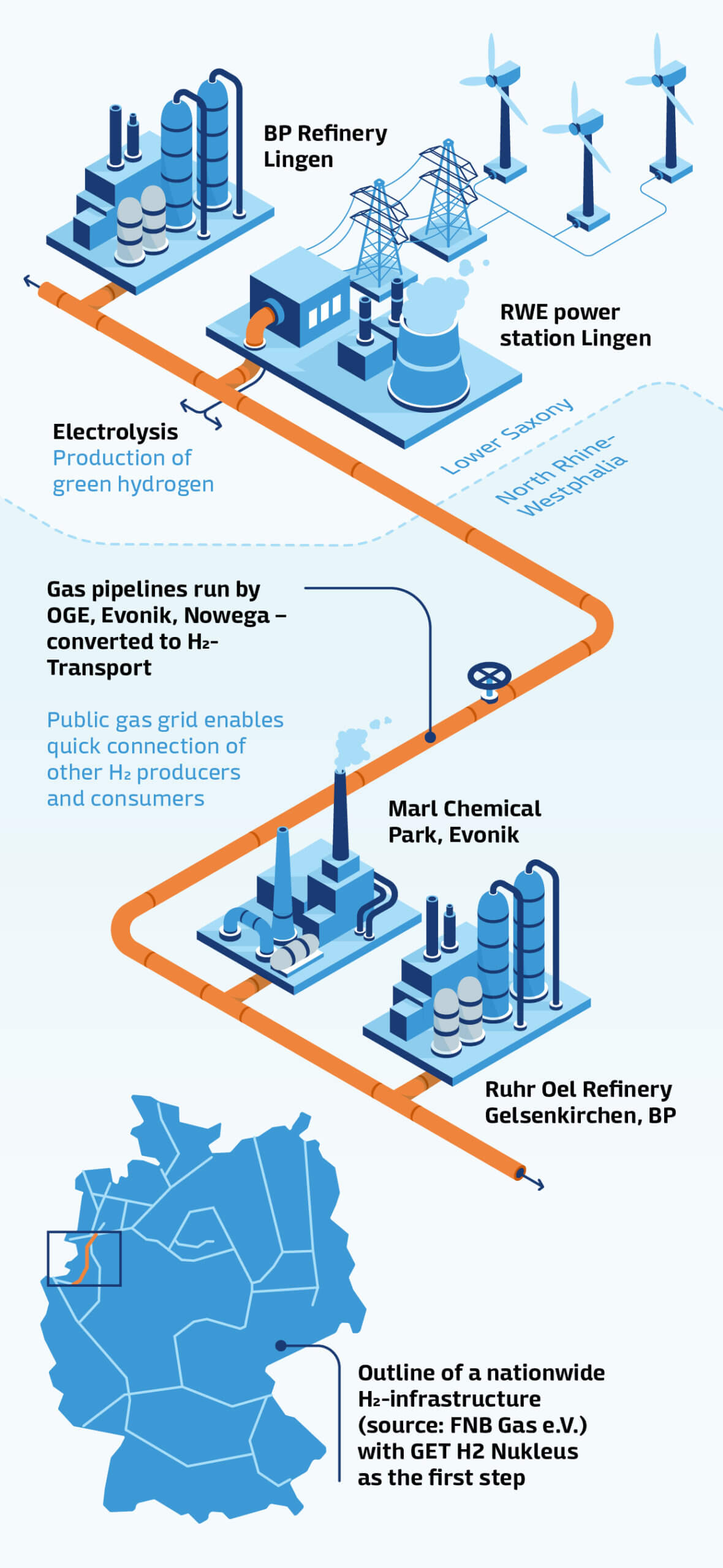

Hydrogen: The energy carrier of the future

Jorgo Chatzimarkakis and Hans-Josef Fell discuss the role of hydrogen in the energy supply of the future.

Hydrogen

Extremely useful

From power storage to aviation: Where hydrogen could play a major role in the future—and where it’s already being used today.

In my element

“My fate depends on hydrogen”

Kurt Frieden likes to get carried away through the air by hydrogen – the lightest element on earth.

ELEMENTS Newsletter

Get fascinating insights into the research Evonik is conducting, and its social relevance, by subscribing to our free newsletter.