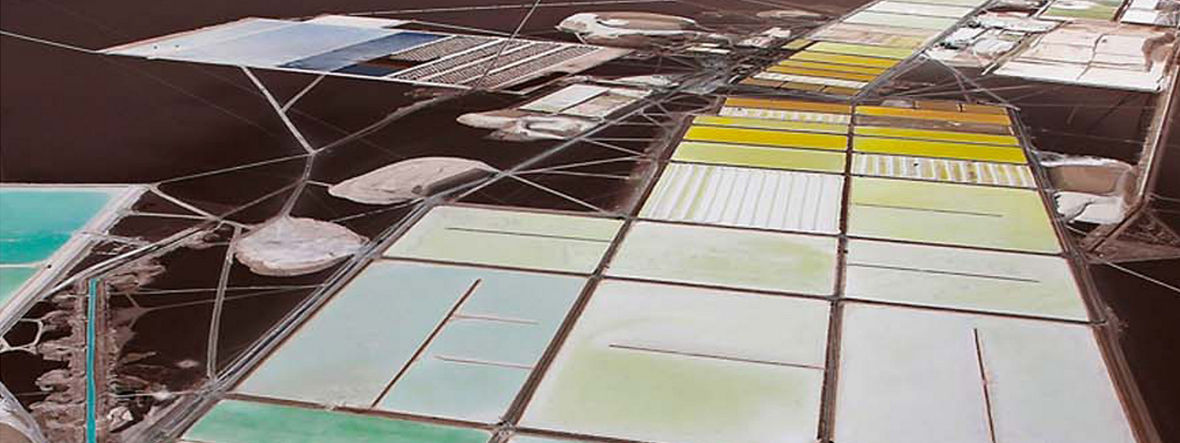

Green, turquoise, yellow—the gigantic basins glow in countless nuances of color under the blazing sun. The salt flats in the seemingly endless plains of the Atacama Desert in Chile are one of the chief sources of “white gold”: lithium. In Australia, even larger volumes of lithium are extracted from hard rock minerals in open-pit mines that are more than a hundred meters deep. Along the sides of these pits, trucks slowly make their way upward and downward on narrow spiraling tracks.

The gigantic extraction sites are a widely visible sign of the global transformation of transportation: away from combustion engines and toward electric drive systems with rechargeable batteries that contain large amounts of lithium. Some of the factors that benefit the environment on the one hand are leading to considerable damage on the other. In the Atacama Desert the sun causes the water to evaporate, increasing the concentration of lithium without any additional input of energy. But the extraction process requires huge amounts of water, and that causes the already scarce groundwater to sink to even deeper levels. More and more often, open-pit mines like those in Australia are leading to conflicts with the local inhabitants. Evonik is working to find a solution to this dilemma—on the basis of the company’s membrane expertise.

Electric mobility is the driver

Experts agree that electric mobility will not make any progress in the decades ahead if there is a lack of the relevant battery materials such as lithium, cobalt, and nickel. On the contrary, the need for lithium carbonate and lithium hydroxide, which are crucial raw materials for the production of lithium-ion batteries, will grow by leaps and bounds. Up to ten kilograms of these materials are used in each electric vehicle.

In 2018 the global demand for lithium carbonate equivalents amounted to 59,000 tons. According to calculations by the US lithium provider Albemarle, by 2025 this amount will already have grown to 650,000 tons—more than 11 times the previous figure. Lithium is also needed for other applications, such as the production of ceramics and lubricants. “However, the crucial driver of the demand for lithium will be electric mobility,” says Dr. Elisabeth Gorman, who is responsible for new business development in the field of lithium recycling at Creavis, Evonik’s strategic innovation unit and business incubator.

»The crucial driver of the demand for lithium will be electric mobility.«

ELISABETH GORMAN BUSINESS DEVELOPMENT MANAGER AT CREAVIS

Recycling is becoming more attractive

In order to cover this increased need for lithium in the future, companies are investing in the expansion of lithium extraction and facilities for processing this raw material. In the future, recycling will provide another important way to obtain lithium. At its Hanau and Marl locations, Evonik is working on a development project for extracting ultrapure lithium from battery wastes.

The recycling of lithium from old batteries would solve two problems at once: the need to meet the rapidly growing demand for lithium, and the responsible disposal of the batteries, which still have enough residual charge in them to spark fires if they are not properly handled. Today the recycling of lithium is complicated and costly. As a result, at the end of the batteries’ life cycle almost all of this material ends up in the trash. Even the proportion of lithium that remains in the recycling facility together with other residues after the recovery of cobalt and nickel is often chemically bound with the process slag. This slag is simply used by the construction industry as a mineral aggregate in ready-mixed concrete—a shameful end for the “white gold.”

And the amount of lithium that ends up in landfill today is only a hint of the challenge we will face in the future. We are still only at the beginning of the age of electric mobility. Several stages on the road to recycling are becoming apparent. Batteries that are now in use will remain on the road for a number of years. In many cases, when the vehicle that they powered is scrapped at the end of its life cycle, the rechargeable batteries are still capable of 70 to 80 percent of their original performance. They can be removed and interconnected in containers to form electricity storage units. Mercedes-Benz launched pilot projects with “second-life” batteries of this kind at various locations years ago in order to safeguard production plants from fluctuations in the power grid.

However, the use of these rechargeable batteries will eventually no longer be worthwhile. At that point, the focus will shift from battery disposal to recycling. The recycling of lithium and other battery components is becoming increasingly attractive from an economic perspective. The prices of cobalt and nickel have more than doubled over the past two years. It’s true that the price of lithium carbonate decreased slowly and continuously until the beginning of 2021, but since then it has increased almost tenfold. As a result, all the essential components of a lithium-ion battery have become so expensive that reuse is not only practical from an environmental perspective but also pays off in economic terms. “Meanwhile, many countries are increasing the regulatory pressure,” says Elisabeth Gorman.

By 2026, companies in the European Union will be required to recover at least 35 percent of the lithium in used batteries. That figure will increase to 70 percent by 2030. “The EU is also defining minimum standards for the processing of batteries,” adds the Evonik expert. “By 2030, new batteries will have to contain at least 12 percent recycled cobalt, 20 percent recycled nickel, and four percent recycled lithium.” Back in 2018, China required its domestic automobile production plants to find solutions for batteries that have completed their first life cycle. The USA still has not passed a nationwide regulation in this area, leaving the problem to be solved by the individual states.

In order to meet the EU’s quotas in the future, recycling capacities must be rapidly expanded. According to predictions, old batteries with a total weight of 100,000 tons will be ready for recycling in the European Union by 2023. The number of electric vehicles that have already been sold leads to estimates that by 2025 that figure will already be 300,000 tons in the EU and a million tons worldwide. Efforts to extract lithium from used batteries are increasing everywhere. Another reason for this is that the transportation of freshly extracted lithium salts from distant regions such as South America and Australia is energy-intensive and thus increases companies’ CO2 footprint. Shipping raw materials is expensive in itself, and in some countries customs duties are imposed as well. It seems logical that if a raw material is already available in a given region it should be used there for as long as possible.

Lithium from "black mass"

Evonik has been watching this development with growing interest for years now. The winner of the in-house idea competition Ideation Jam in 2019 was the Blue Lithium team. The team originally came up with the idea of extracting lithium from seawater, but it eventually switched to a technology that filters the residues from recycling facilities. This process was developed further within the company for one year; since then, the development process has been driven by Creavis. The basic objective is to extract lithium from “black mass” using the smallest possible inputs of energy and chemicals. By “black mass,” the experts mean the material that is left after the plastic components of rechargeable lithium-ion batteries have been removed and the remainder has been shredded.

Lithium produced via electrolysis

Wastewater containing lithium from the recycling facility flows between the anode and the ceramic membrane developed by Evonik. The positively charged lithium ions are attracted by the negative cathode and move toward the membrane. The membrane also contains lithium ions (Li+), and as a result the lithium ions from the wastewater flow can hop from one localized point in the membrane to the next. By means of this “hopping mechanism” the membrane always releases exactly as many lithium ions on the cathode side as it receives on the anode side. At the same time, the water reacts with the electrons at the cathode to form hydrogen (H2) and hydroxide ions (OH-), which react with the lithium ions to form lithium hydroxide—the desired product.

Some processes for reprocessing the finely ground contents of “black mass” are already being implemented. They are based either on smelting processes (which are known as pyrometallurgical processes), the use of alkaline solutions (hydrometallurgical processes) or a combination of the two. These processes have proved their worth in the case of cobalt and nickel, which today are already being isolated with high yields and reused as secondary raw materials. However, the residue that remains still contains lithium, whose recovery has so far hardly been economically worthwhile.

A more sustainable process

However, Evonik is now working together with other companies that specialize in the ongoing use of the materials in “end-of-life” batteries. The aim is to develop more advanced technologies for extracting the white gold from the black mass. These companies are experienced in the recycling of lithium-ion batteries that are used in typical household and industrial applications. So far they have been recovering aluminum, copper, steel, and stainless steel.

However, the current processes for recycling lithium are not efficient enough, so this metal is being recovered only in small quantities. Together with the recycling companies, Evonik now aims to find a better process that will close the gap in the circular economy of lithium as a raw material for batteries. Many of the processes that have been commonly used to date for recovering lithium from battery residues work with a complicated precipitation process. In this process, the concentration of the lithium salts in an aqueous waste flow is increased and the lithium is then precipitated with sodium carbonate, which is also known as soda. The lithium carbonate thus produced must be expensively separated from the other reaction products, and it must then be converted into lithium hydroxide through the addition of calcium hydroxide. Only at that point is it once again available as a raw material for the production of rechargeable lithium-ion batteries. The entire process is cost-intensive, requires additional chemicals, and uses large amounts of water. As a result, it is not very appealing to battery recycling companies in economic terms.

The experts at Evonik are working to develop a simpler and more sustainable process. Their aim is to recover the lithium in a continuous process using a single step. They are backing an electrochemical process for purifying the lithium salts contained in the aqueous waste flows. Patrik Stenner is an expert in this field. He works as a process engineer in the Process Technology & Engineering unit at the Hanau location, where he is the head of the Electrochemical Processes & Exploration group.

In his laboratory, Stenner is developing an innovative electrolysis cell whose special feature is a lithium-selective ceramic membrane between the anode and the cathode. The aqueous waste flow from the recycling facility is channeled through the cell. Lithium ions react with the hydroxide ions (OH-) that are created in the process to form lithium hydroxide and hydrogen (H2). “The product is so pure that it fulfills the high standards for ‘battery-grade’ material without any need for further processing. As a result, it can be used immediately for battery production,“ says Stenner. Can large-scale production now begin? Patrik Stenner smiles. “The results in the laboratory look very promising, and we’re already testing a prototype. But this is a research project, and there’s still a whole series of questions that have to be answered before we can implement the process on an industrial scale,“ he says.

However, it’s already becoming obvious that this process will be more manageable, more efficient, and more sustainable than the previous ones. The conductivity of the ceramic membrane is excellent on a laboratory scale, with a recovery rate of more than 99 percent. Initial comparisons suggest that the new process should be more economical and cost-efficient than the processes previously used. In this development process, the Evonik experts are benefiting from their experience with membranes and also their particle know-how. Because they are specialists regarding materials and their characteristics and applications—silicon dioxide and other special oxides, for example—at the nanometer scale, they know exactly how they can create a ceramic membrane that allows only lithium ions to pass through. They are now about to conduct the first tests with “genuine” wastewater flows. After that the next step, setting up a pilot facility, has to succeed.

Lithium from natural sources

In Germany, a country with an automaking tradition, there is a huge demand for lithium. Tesla just recently commissioned an automobile production plant at a site near Berlin, and the company’s CEO Elon Musk also plans to build a battery factory adjacent to it. Automakers such as Volkswagen, Mercedes-Benz, BMW, Audi, and Porsche also have plans of their own. Most of them want to cooperate with battery producers to build battery factories near their production locations. As a result, they are creating a tremendous demand for lithium in the heart of Europe.

One potential source of lithium might be available in Saxony, which has a long-established mining industry in the Ore Mountains near the border between Germany and the Czech Republic. Lithium has been discovered in the Zinnwald mine, which was largely closed down 75 years ago. The lithium can be found underground in a vein that extends all the way to the Czech Republic. It is estimated that more than 35 million tons of ore lie under the earth in this region. The mineral known as zinnwaldite contains 1.6 percent lithium on average. On just the German side of the Ore Mountains ridge, the deposit contains approximately 125,000 tons of lithium. That corresponds to about 650,000 tons of lithium carbonate, which would be enough to equip about 20 million electric cars such as the ID.3 from Volkswagen, according to Armin Müller from the operating company Deutsche Lithium. The new Tesla factory is located only 250 kilometers from the mining region. That’s a clear locational advantage over Chile and Australia.

The Evonik process can also be used with natural deposits of lithium brine—and that would open up another stream of raw materials in Germany. The Australian company Vulcan Energy has joined forces with the local energy utility in the Upper Rhine Graben region in the western part of Germany. Tesla is owned by Elon Musk, the world’s wealthiest man, and Vulcan Energy belongs to Gina Rinehart, a multibillionaire who is one of the world’s richest women. Her company’s ambition is to extract lithium without generating any CO2 emissions. The plan is to extract lithium from thermal deep water that is brought up from underground volcanic rock to the earth’s surface. The deep water, which has a temperature of 120°C, is pumped to the surface. The heat is utilized, the lithium is extracted, and the now cooler water is then pumped back into the depths of the earth in another area. The RAG-Stiftung, Evonik’s biggest shareholder, plans to establish a similar process using pit water from decommissioned mines in the Ruhr region.

Development until 2025

The Evonik experts Gorman and Stenner think the application fields of primary lithium extraction are exciting. “However, for us that would actually be the second step,” says Gorman. “We are initially focusing on secondary lithium extraction—in other words, on recycling.” Both of them are confident that they will have developed the ceramic membrane process to market maturity within the next three to five years.

Gorman emphasizes that Evonik would not do the recycling itself. This task would be performed by the operators of recycling facilities, who could increase their yield of raw materials relevant for battery production with the ceramic membrane “made by Evonik.” Specialized companies of this kind are currently popping up in large numbers. Most of them are set up jointly by battery manufacturers, recycling companies, and automakers.

The Evonik experts believe that China, a global pioneer in the field of electric mobility, will be a significant market. According to a study conducted by the PWC consulting firm, a million new electric cars rolled out onto China’s roads in the first quarter of 2022—two thirds of the world’s registered battery-driven cars. In China, 15 percent of all new vehicles are electric. By comparison, that figure is 13 percent in the most important European markets, seven percent in South Korea, five percent in the USA, and only one percent in Japan.

For a long time, German automakers found it difficult to gain a foothold with electric cars in the Chinese market. But now they have doubled their market share from two to four percent within one year, thanks to new models and expanded on-site production. Greater vertical integration would help German companies to expand this channel, according to the automotive expert Jörn Neuhausen from PWC. “In the future, investments in local battery production, the construction of gigafactories in Europe and the USA, and partnerships with raw material producers could play a bigger role for automakers in helping to reduce their dependence on volatile supply chains,” he says.

»We want our process to be more effective and more energy-saving than previous methods«

PATRIK STENNER PROCESS ENGINEER AT EVONIK'S HANAU LOCATION

GLOSSARY

Cell The smallest electrochemical current-producing unit of a battery. The cell consists of two electrodes, an electrolyte, a separator, and a housing. When the battery discharges, the stored chemical energy is transformed into electrical energy by means of the electrochemical redox reaction.

Battery An interconnected group of several cells. In primary batteries the reactions during the discharge process are partially or completely irreversible. In other words, the battery cannot be recharged.

Rechargeable battery A secondary battery in which the discharge reactions are largely reversible. As a result, it is possible to transform chemical energy into electrical energy and vice versa multiple times.

Lithium battery A primary battery in which lithium (Li) is used as the active material in the negative electrode.

Lithium-ion battery A general term for a rechargeable battery based on lithium compounds. The reactive materials in the negative and in the positive electrode and in the electrolyte contain lithium ions. Lithium-ion rechargeable batteries have a higher specific energy than other types of rechargeable batteries. Because deep discharging or overcharging causes them to lose capacity, they need electronic protection circuits.

Lithium-polymer battery A special type of lithium-ion rechargeable battery in which the electrolyte is a solid or gelatinous polymer-based foil. This enables a more open design, for example one that is especially flat. This type of battery is mainly used in electric vehicles.

The danger of a battery "gap"

The key success factor for the surge in electric mobility is the availability of batteries and the raw materials they contain. The Roland Berger consulting firm assumes that the global demand for lithium-ion batteries will increase to 2,800 gigawatt-hours (GWh) by 2030, and that about 30 percent of that demand will be for the production of electric cars. At the moment, the demand amounts to approximately 390 GWh. Wolfgang Bernhart, a senior partner at Roland Berger, believes that there is a high risk of “encountering a battery gap.” According to an analysis conducted by the Center for Automotive Research, which is based in Duisburg and Beijing, in the next six years there will be a global shortfall of battery cells for almost 15 million new cars. It will be caused mainly by shortages of basic materials such as lithium, cobalt, and nickel. “Access to raw materials originating in the circular economy is existentially important for the automobile industry, because otherwise the automakers won’t be able to reach their own targets or the legally prescribed climate goals in the medium term,” says Elisabeth Gorman.

The technology she and her colleagues are developing at Evonik and its partners could improve the sustainability of electric mobility and do even more. It could also help to ensure that less of the natural environment is sacrificed to the demand for lithium in the wide expanses of the Atacama Desert in Chile as well as in the Australian outback.